Unpacking the Performance of Vanguard S&P 500 ETF (VOO): A Historical Analysis

Table of Contents

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- Vanguard S&P 500 ETF (VOO) Stock Price, News & Info | The Motley Fool

- Daily VOO stock price trend forecast analysis pretimingによるAMEX:VOOの分析 ...

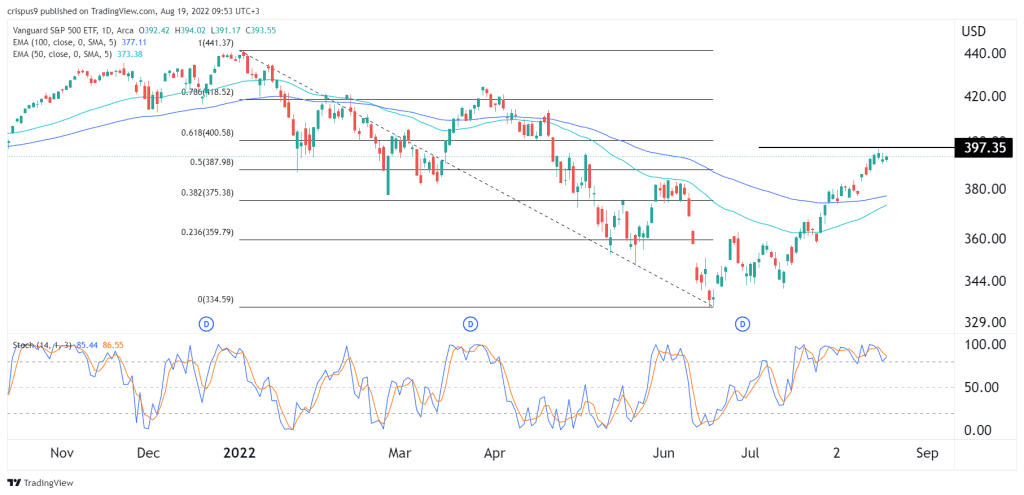

- VOO Stock Price: Is This a Bear Market Rally or a Bull Run

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- Voo investment calculator - RehmanSandi

- Vanguard S&P 500 ETF Trade Ideas — AMEX:VOO — TradingView

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO Stock Price Today (plus 9 insightful charts) • ETFvest

- Vanguard VTI vs VOO - What is the Best ETF? (Index Funds 2019) 🏆 - YouTube

Introduction to VOO

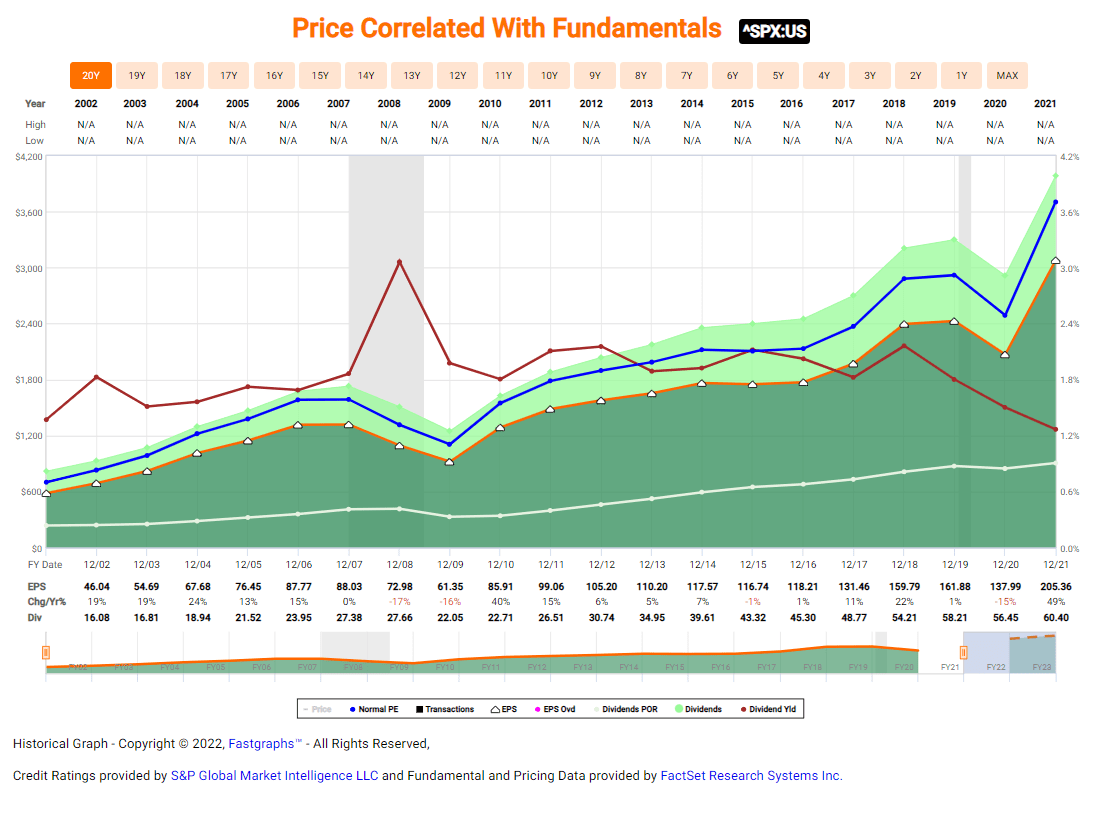

Historical Performance

Here is a breakdown of VOO's historical performance:

- 1-year return: 25.1%

- 3-year return: 14.1%

- 5-year return: 15.6%

- 10-year return: 13.5%

Key Drivers of Performance

Several factors have contributed to VOO's strong performance over the years. These include: Diversification: By holding a broad portfolio of 500 stocks, VOO provides investors with instant diversification, reducing exposure to individual stock risk. Low costs: VOO's low expense ratio of 0.04% means that investors can keep more of their returns, rather than paying high fees to fund managers. Tracking error: VOO has a low tracking error, meaning that it closely follows the performance of the S&P 500 Index, minimizing deviations from the benchmark. The Vanguard S&P 500 ETF (VOO) has established itself as a reliable and low-cost way to gain exposure to the US stock market. With its strong historical performance, broad diversification, and low costs, VOO is an attractive option for investors seeking to build a long-term portfolio. While past performance is not a guarantee of future results, VOO's track record suggests that it can be a valuable addition to a diversified investment strategy. As with any investment, it's essential to conduct thorough research and consider your individual financial goals and risk tolerance before investing in VOO or any other ETF.Source: Yahoo Finance

Note: The data and information in this article are subject to change and may not reflect the current market situation. It's always recommended to consult with a financial advisor or conduct your own research before making investment decisions.